Are you generating electronically or on paper, but the main fact is donation receipts are equally important for donors and nonprofit organizations.

Donation receipts hold importance beyond IRS requirements. They help maintain donation records, track contributions, generate donation reports, and facilitate tax deductions. All this results in maintaining a good relationship with donors.

In this blog, we will see in-detail insights regarding donation receipts for nonprofits.

Let’s Start!!

What Do You Mean By Donation Receipts?

Nonprofits, churches, or charity organizations provide donors with written proof of successful donations through donation receipts. These receipts serve as confirmation that the money received contributes to a good cause.

Donation receipts are the legal records of the receiving gifts from donors to the nonprofit organization.

Any legally registered nonprofit organization can issue both informal receipts and official donation tax receipts.

Basically, it’s gratitude from an organization to the donors for receiving gifts in a written form as an acknowledgment letter.

Donors can also use the donation receipts provided by nonprofits for the tax deduction purpose.

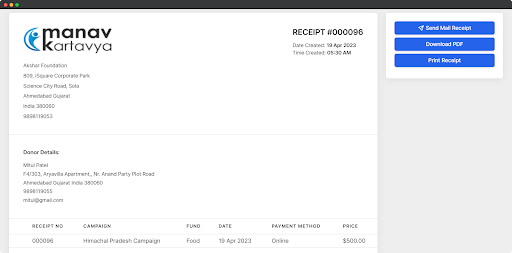

With the Non Profit Donation Software like DonorKite, you can automatically send donation receipts immediately or at a scheduled time. DonorKite will generate the receipts and send them to donors by email.

Why Do Donors Care About Donation Receipts?

At first, Donation Receipts are the official confirmation for donors that a nonprofit organization has received the donation (money or gifts).

Online approaches make it easier to accomplish tasks, but they also raise doubts: Did they really receive it? Was the task successful? Did the transaction go through?

So, more importantly, the donation receipts give satisfaction and official confirmation of receiving the donation amount.

Moreover, donation receipts help donors to tax refunds. If the donor wants to claim a tax deduction then, they can use the organization’s official donation receipt legally. And also, the contributors can better manage their finances by using donation receipts.

Before reporting a charitable contribution on their federal income tax return, a donor must acquire a written receipt of the donation if it exceeds $250.

What Matters to Nonprofits About Donation Receipts?

At most, donation receipts help in tax deduction for people and businesses who donate, and due to this nonprofit had great reason to encourage donations. That means, indirectly tax receipts are beneficial to fundraisings.

By sending donation receipts and a thankyou note to the donors, you are appreciating people for their good work as a nonprofit organization. This will build the faith, and transparency between donors and nonprofit organizations.

Actively sending donation receipts to the donors for every donation and gifts proved as a key to building loyal and long-lasting relationships between contributors and organizations. Although, it’s a perfect time to reflect on cherishing for donations towards the donor.

If you deliver a donation receipt on time to the first-time-donor, it will create a great impact on their thoughts for your organization.

Possibly they come for recurring donations by considering your responsible behaviour of providing instant tax receipts for donations.

Finally, providing receipts for donations enables your organisation to maintain track of past contributions. For proper accounting and financial administration, this data must be stored.

Let’s have a closer look at types of donation receipts.

Types Of Donation Receipts

Here, we have explained all the types of donation receipts, have a look!

Charitable donation receipt

A letter, email, or official receipt form serves as a charitable donation receipt to indicate to donors that the organization has received their donation or gift.

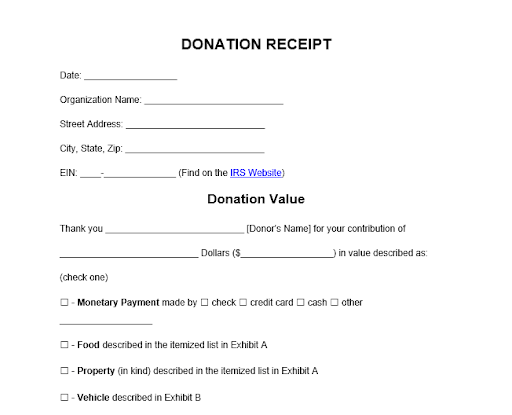

This receipt contains information such as the name of the donors, the name of the organization, the donation amount, gift type, etc.

As per the IRS guidelines, for nonprofit organizations, providing receipts is mandatory on a gift worth $250 and more.

In-kind donation receipt

In-kind presents represent goods or services rather than cash. Presents of products hold a tangible price value, unlike gifts of time and services that lack monetary value and are not deductible from taxes.

Givers, not nonprofits, must determine the monetary value of donated products. In-kind donation receipts should include the donor’s name, nature of the gift, and received date.

Cash donation receipt

Nonprofits provide a written cash donation receipt as documented proof of accepting a gift donation in the form of cash.

If the donor wants to deduct the donation from their overall income, the receipt serves as proof to the government of the transaction’s legitimacy.

Stock gift donation receipt

As the name suggests, the stock gift donation receipt is the official receipt or proof of a corporation’s gift of stock shares.

This receipt contains the details of the number of shares and the corporation’s name but shouldn’t place a rate value on the shares.

Even though it isn’t necessary, it’s excellent practice to send a follow-up letter outlining the number and value of the donated shares as of the gift date.

Silent auction receipt

There are some silent auction attendees with great hearts who have willingly left the items they purchased at the event. The organization must provide a receipt to them.

The name of the organization, the occasion’s date, and the names and prices of each item the participant bought should all be listed on the receipt.

End-of-year donation receipts

Your organisation must issue year-end giving statements, called donation receipts, to select contributors who made contributions of $250 or more in order to comply with legal requirements and enable your donors to write off their contributions on their taxes.

Further, Learn about the donation receipt issued time and the ideal format of donation receipts.

What Should a Donation Receipt Contain?

To ensure that your donation receipt is a legitimate receipt rather than merely an appreciation, there are a few items you should include on it. These consist of:

- The full name of the donor;

- The full name of an organization that receives donations;

- A declaration that the organization is a public charity approved by the IRS as being exempt from paying taxes under Section 501(c)(3);

- An individual unique donation ID for quick look-up and reference purposes;

- The donation type;

- If true, a declaration that no goods or services were exchanged in exchange for the donation; else, a declaration of the fair market worth of the commodity or service offered;

- The total amount of donation;

- The authority’s name and the signature;

- It could be a good idea to include the request number as well if the donation receipt is being sent as a result of a fulfilled donation request;

- Although it is not necessary, it is a good idea to include a note of appreciation in your donation receipt even though it is not required by law.

If intangible religious benefits are provided by your organization, then do not forget to add a line “The organization provided intangible religious benefits or services to the donor.”

Click on the below-listed links to check out the donation receipt format.

When Should Donation Receipts Be Issued?

There is not a certain time of issuing donation receipts for your donors. In case of year-end donations many nonprofit organizations provide the receipt at the end of the year or in a month of january.

But, from the donors’ point of view; they expect gratitude for any size of donation soon. It’s a very genuine suggestion to try to send out the donation receipt within 24-48 hours of the donation being received.

It is possible to send a donation receipt right after the online donation and 24-48 hours of other donations received with the help of Church Donation Software like DonorKite.

Legal Obligations

As per the IRS publications and regulations of 501(c)3 donation rules, we have listed the legal requirements for writing any donation receipt on behalf of a nonprofit organization.

- Any type of donation worth $250 or more must be responded to with receipts;

- Penalties of $10 per contribution, up to $5,000 for a specific campaign, are assessed for failure to provide a receipt;

- A description of a non-cash contribution, but not its value, must be included on in-kind donation receipts;

- The statement “no good or service was issued in exchange for the donation” must be mentioned in each donation receipt;

- Complete detail of the item and its ascribed fair market value must be included if something else (such as a service or good in a silent auction) was given in exchange for the contribution.

Now, consider the best ideas for donation receipts to make them more engaging.

Donation Receipts: Tips & Best Practices To Make It More Engaging

1. Keep copies of donor receipts in storage

Owning your own filing system is crucial. It merely makes sense to maintain track of the donation receipts you’ve given out, and it keeps everything organised.

Your file system will be your good friend if you ever need to reissue a receipt, obtain a copy of a receipt, or provide verification of a donation. It doesn’t matter if you save these documents on physical media, digital media, or a combination of both.

2. Employ a special serial number or Donation ID

Keeping your records organised is simple if you assign each donation a special serial number or donation ID.

The use of serial numbers gives you the ability to quickly search through your files, link collections of receipts to particular time periods, and give each receipt a unique identity that contains all of its other data.

You can save time and effort by creating serial numbers with Charity Donation Software like DonorKite.

3. Formatting should be consistent

Make sure the format is uniform when issuing donation receipts, whether you do so in person or online. Maintaining consistency in receipts is simple with the aid of a donation database software because your software will let you adhere to the format of your choice.

If giving out receipts in person, print out a template and follow it exactly. You won’t have to cope with various formats or haphazard sheets of paper in this method. You lessen the possibility of forgetting to gather the data your company needs.

4. Together with your receipt, send a “Thank You”

Although the receipting process is fairly transactional, you should seek out any chance to be relational once you develop strong ties with your donors. You can do that by including a letter or note of gratitude with the donation receipt.

An administrative need is transformed into an opportunity to foster additional goodwill by showing appreciation. Although receipts are lovely, they aren’t always a meaningful way to express gratitude.

5. Clear out what is tax deductible

There are tight restrictions on what gifts can be deducted from taxes in certain nations and areas. Given that many forms of gifts to organisations have no tax repercussions, it is crucial to know what is and is not deductible.

Consult your government website if you’re unsure of the laws in your nation. The rules governing tax advantages for charitable giving vary depending on where you live: the IRS in the US, the CRA in Canada, and the ATO in Australia.

List of Donation Management Software Who Provides Donation Receipts

Here, we have filtered the best 10 donation management and fundraising software for nonprofits who provide automated receipt generators and sending features.

- DonorKite

- B Generous

- BetterUnite

- EinNel EDOM

- GiveWP

- Causeview

- NonprofitCore

- Kambeo

- ParishSOFT Giving

- Andar/360

Conclusion

In conclusion, We have explored the importance of donation receipts, their role in building trust with donors, and their significance in meeting legal and tax requirements.

In this guide, we highlight key elements to include in a donation receipt: organization’s name and contact information, donor details, gift description, and the required statement of no goods or services provided in return.

We have also discussed the various formats and methods for issuing donation receipts, including paper receipts, electronic receipts, and acknowledgment letters.

Furthermore, we have delved into the essential legal considerations surrounding donation receipts, such as IRS guidelines for tax-deductible contributions and the significance of maintaining accurate records.

Donation receipts play a vital role in the nonprofit sector, serving as a means to acknowledge donor contributions, maintain compliance with legal requirements, and build lasting relationships.

By following the guidelines outlined in this ultimate guide, nonprofits can optimize their receipting practices, ensuring a seamless and gratifying experience for both the organization and its supporters.

With proper documentation and heartfelt acknowledgments, nonprofits can continue making a positive impact on their communities and achieving their missions with the support of their dedicated donors.

WE WISH YOU A GOOD EXPERIENCE WITH DONATION RECEIPTS AND DONORS!!!

Want to read more?

- 21 fundraising ideas for churches: Boost Donations In 2023

- Top 7 Donor Management Fundraising Software For Nonprofits

- Top 3 Charity Donation Tracking Software: Donation Made Simple

Frequently Asked Questions (FAQs)

What is a donation receipt?

A donation receipt is a written acknowledgment provided by a nonprofit organization to a donor, confirming the contribution made. It serves as a record for the donor and helps them claim tax deductions, if eligible.

Why are donation receipts important for nonprofits?

Donation receipts are crucial for nonprofits as they provide evidence of charitable contributions made by donors. They help maintain transparency, build trust with donors, and comply with legal requirements related to tax-deductible donations.

Can donation receipts be issued electronically?

Yes, in many jurisdictions, electronic donation receipts are accepted as long as they meet the necessary requirements.

Electronic receipts can be sent via email or provided through an online donation management software. It is important to ensure that electronic receipts are secure, accessible, and contain all the required information.

Are there specific legal requirements for donation receipts?

The legal requirements for donation receipts may vary depending on the country or region. Nonprofits should consult local laws or seek professional advice to ensure compliance.

In general, donation receipts should meet certain criteria, such as being issued in a timely manner, containing accurate information, and meeting the requirements for tax-deductible donations.

Can a donor claim a tax deduction without a donation receipt?

In most cases, a donor cannot claim a tax deduction for a charitable contribution without a proper donation receipt. Tax authorities typically require a valid receipt as proof of the donation. It is the responsibility of the donor to obtain and retain the receipt for tax purposes.

Can a donation receipt be used as a thank-you letter?

Yes, a donation receipt can also serve as a thank-you letter.

Nonprofits can include a personalized message expressing gratitude for the donor's generosity. However, it is important to ensure that the receipt portion contains all the necessary information required for tax purposes.

How should nonprofits handle in-kind donations?

For in-kind donations (non-cash items), nonprofits should provide a detailed description of the donated items in the donation receipt. This includes specifying the type, quantity, and estimated fair market value of each item. If the value exceeds a certain threshold, additional requirements or appraisals may be necessary.