For U.S. charities and nonprofits, year-end donation reports are commonly used to summarize a donor’s contributions over a calendar year. While these reports are helpful for donors, they must follow specific IRS rules to be considered valid written acknowledgments for tax purposes. Misunderstanding what is required versus optional can lead to non-compliance and problems for donors claiming deductions.

This article explains, in simple terms, what an IRS-compliant year-end donation report is, which rules apply, what information is compulsory, and where charities often make mistakes.

What a Year-End Donation Report Is

A year-end donation report is a summary provided to a donor that lists their contributions made to a charity during a specific year, usually the calendar year. Many nonprofits send this at the end of December or in January to help donors with tax preparation.

From the perspective of the Internal Revenue Service, a year-end donation report can qualify as a written acknowledgment only if it contains all required elements.

Important point:

A year-end donation report is not a special IRS document. It is simply a format charities use to deliver required acknowledgments in one consolidated statement.

Does the IRS require a Year-End Donation Report?

No.

The IRS does not require charities to issue a year-end donation report.

What the IRS does require is that donors receive a written acknowledgment for certain donations if they want to claim a tax deduction.

A year-end donation report is:

- Optional for the charity

- Useful for the donor

- Acceptable only if it meets IRS acknowledgment rules

IRS Rules That Apply to Year-End Donation Reports

If a charity chooses to send a year-end donation report, it must follow the same rules that apply to written acknowledgments.

The $250 Substantiation Rule

If a donor makes one or more contributions of $250 or more, the donor must have a written acknowledgment from the charity before claiming a deduction.

A single year-end donation report can cover multiple donations if it clearly lists them and includes all required statements.

Timing Requirement

The donor must receive the acknowledgment on or before the date they file their tax return, or by the tax return due date (including extensions), whichever comes first.

Information That Must Be Included

(Required vs Optional)

The IRS is very specific about what must appear in a compliant year-end donation report.

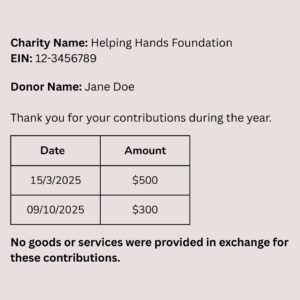

Required Information (Mandatory)

| Required Item | Explanation |

| Charity name | Legal name of the organization |

| EIN | Employer Identification Number |

| Donor name | Individual or entity that made the donation |

| Donation date(s) | Exact date(s) contributions were received |

| Donation amount | Cash amount or description of non-cash items |

| Goods/services statement | Must clearly state whether any goods or services were provided |

| Value disclosure (if applicable) | Fair market value of goods/services for benefit donations |

Optional Information (Allowed, Not Required)

| Optional Item | Notes |

| Annual total amount | Helpful but not mandatory |

| Thank-you message | Allowed but not compliance-relevant |

| Internal reference number | For internal tracking only |

| Donation method | Check, cash, online, etc. |

Key rule: Optional information must never replace required disclosures.

Annual Giving Statements for 501(c)(3) Organizations

Annual giving statements for 501(c)(3) organizations are often used as year-end summaries. These statements can serve as valid IRS acknowledgments, but only when they fully meet IRS requirements.

When They Are Acceptable

- All required donation details are listed

- Required IRS wording is included

- Benefit disclosures are handled correctly

- Non-cash donations are properly described

When They Are Not Acceptable

- Missing “no goods or services” wording

- Listing pledges instead of completed donations

- Omitting donation dates

- Combining donations without clarity

Example (Not Compliant):

“Thank you for your support of $1,500 this year.”

Why it fails:

- No dates

- No goods/services disclosure

- No clarification of donation type

Treatment of Different Donation Types in Year-End Reports

Different donations must be handled differently to remain compliant.

| Donation Type | Can Be Included? | Special Rule |

| Cash | Yes | Amount and date required |

| Non-cash / in-kind | Yes | Description required; no value assigned by charity |

| Benefit (quid pro quo) | Yes | Fair value of benefit must be disclosed |

| Pledge | No | Pledges are not completed donations |

Example: Benefit Donation

If a donor gave $300 and received a dinner valued at $75, the report must clearly state the fair market value of the benefit.

Format of an IRS-Compliant Year-End Donation Report

There is no official IRS template, but clarity matters. A compliant report should be easy to read and unambiguous.

Sample Format

Each line serves a compliance purpose. Removing required wording breaks compliance.

Generating Year-End Donation Reports Without Compliance Errors

Common mistakes charities make include:

- Using summary totals without listing dates

- Forgetting benefit disclosures

- Including pledges as donations

- Assuming a year-end report always replaces individual receipts

When generating year-end donation reports, charities should verify that every required IRS element is present, not just that the document “looks right.”

When a Year-End Donation Report Is Not Enough

A year-end donation report does not meet IRS requirements if:

- A donor received goods or services and no value is disclosed

- Non-cash donations lack descriptions

- Required wording is missing

- Donations of $250+ lack proper acknowledgment language

In these cases, individual donation receipts may still be required.

Why IRS Compliance Matters for U.S. Charities

IRS compliance protects:

- Donors’ ability to claim tax deductions

- The charity during audits

- Accurate record-keeping and reporting

Even unintentional errors can invalidate donor deductions, which damages trust and credibility.

Conclusion

Preparing an IRS-compliant year-end donation report requires more than summarizing totals. Charities must ensure that required disclosures are accurate, acknowledgments are properly formatted, and issued receipts remain consistent with IRS record-keeping expectations. Maintaining control over how receipts are generated, delivered, and corrected is an important part of meeting these compliance obligations.

For U.S. charities that require structured compliance controls, DonorKite supports the generation and sending of donation receipts and year-end reports through workflows that restrict donor-side modifications after issuance.