Accurate donation tax reporting is a core responsibility for charities and nonprofit organizations. Many organizations continue to receive donations through offline methods such as cash, checks, direct deposits, and in-person fundraising activities. While these contributions remain important, managing them without a structured system can lead to reporting gaps, compliance risks, and operational inefficiencies.

Donation tax reporting software built for offline donation management helps charities record every contribution accurately, maintain clear donor records, and prepare reliable tax and audit reports. Using a dedicated Donation Tax Reporting Software allows nonprofits to centralize offline donation data in one place, instead of relying on spreadsheets or manual paperwork, which improves transparency and consistency across records.

This article reviews the seven best donation tax reporting software platforms that support offline donation tracking. Each platform offers different strengths, but one stands out as the most balanced and dependable option for charities.

What Is Donation Tax Reporting Software?

Donation tax reporting software is designed to help nonprofits record and organize offline donations in a structured and compliant manner. These systems allow charities to manually enter donation details, connect contributions to donors, and generate reports needed for financial review and tax documentation.

By centralizing donation records, charities gain better control over their data. This improves accuracy, reduces administrative effort, and ensures that donation records remain consistent across reporting periods.

Why Is Donation Tax Reporting Software Important?

Offline donations do not create automatic digital records, which makes them more difficult to track accurately. Errors in manual recordkeeping can affect financial reports, audits, and regulatory compliance. Donation tax reporting software helps charities overcome these challenges by bringing structure and consistency to offline donation management.

Key reasons this software is important include:

- Reducing errors caused by manual data entry and fragmented records

- Maintaining consistent and verifiable donation histories for audits

- Supporting accurate tax and compliance reporting

- Saving staff and volunteer time through organized workflows

By standardizing how offline donations are recorded and reported, donation tax reporting software enables charities to operate more efficiently while meeting their compliance responsibilities with confidence.

Why It Matters for Charities and NGOs

For charities and NGOs, accountability is essential. Donors, auditors, and regulatory bodies expect organizations to maintain accurate records and demonstrate transparency in how donations are managed. When offline donations are not tracked properly, it can weaken trust and create long-term operational risks.

Reliable donation tax reporting software ensures that offline donations are managed with the same level of accuracy and professionalism as any other financial activity. This directly impacts an organization’s credibility and stability.

This matters because it helps charities:

- Build and maintain trust with donors and stakeholders

- Meet regulatory and audit requirements with confidence

- Improve internal financial planning and reporting accuracy

- Strengthen long-term organizational credibility

By using a structured system for offline donation reporting, charities can focus more on their mission while maintaining clear and reliable financial records.

Best 7 Donation Tax Reporting Software

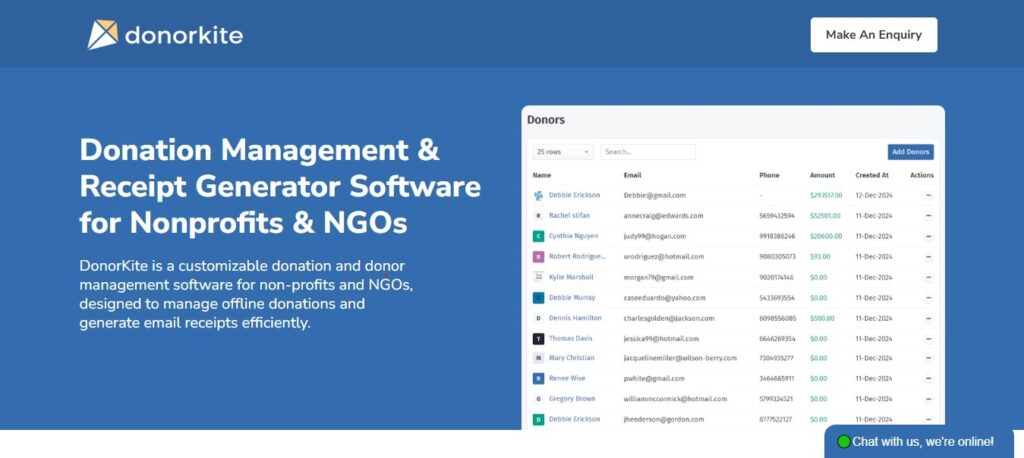

1. DonorKite

DonorKite is a donation management platform designed specifically for nonprofits that rely on offline fundraising. It helps organizations record manual donations accurately, maintain structured donor records, and generate reliable reports for tax and compliance purposes. The platform is built to be easy to use while offering the depth required by growing charities and established organizations alike.

Key Features

- Manual entry for cash and check donations

- Centralized donor profiles with donation history

- Offline donation receipt generation

- Tax-ready and audit-friendly reports

- Clean dashboard for nonprofit teams

Advantages

DonorKite offers the most complete offline donation management experience. It balances simplicity with strong reporting capabilities, making it suitable for both small charities and growing organizations. Its focus on accuracy and offline workflows makes it a reliable choice for donation tax reporting.

2. Givebutter

Givebutter is used by nonprofits that need a straightforward system to manage donation records. It allows organizations to manually track offline donations and organize donor information in one place. The platform is suitable for charities with simple reporting needs and smaller teams managing offline contributions.

Key Features

- Manual donation entry

- Donor data storage

- Basic donation reports

Advantages

Givebutter is easy to adopt and works well for organizations with limited reporting needs. However, it may lack advanced tax reporting features required by larger charities.

3. Bonterra Network for Good

Bonterra Network for Good is commonly used by established nonprofit organizations that require structured systems for donation management and reporting. It supports offline donation tracking by enabling organizations to record and organize manual contributions in a centralized system. The platform is designed for nonprofits with formal processes and compliance-focused reporting needs.

Key Features

- Offline donation entry

- Donor segmentation

- Compliance-focused reporting

Advantages

Bonterra offers strong data organization and reporting depth. It is suitable for larger organizations but may require more setup and training.

4. Kindful

Kindful focuses on helping nonprofits manage donor information while supporting offline donation tracking. It allows organizations to maintain clear donation histories and organize donor records for reporting and internal review. The platform works well for charities that prioritize data organization and donor record accuracy.

Key Features

- Manual donation tracking

- Donor history management

- Standard reporting tools

Advantages

Kindful provides a clean interface and dependable donor recordkeeping. It is useful for organizations that prioritize donor information alongside reporting accuracy.

5. Virtuous

Virtuous supports nonprofits that want a structured approach to managing offline donations and donor data. It enables organizations to record manual donations, maintain detailed donor profiles, and generate reports for financial analysis. The platform is often used by nonprofits with dedicated teams handling data and reporting.

Key Features

- Manual donation entry

- Donor profiles and history

- Reporting for financial review

Advantages

Virtuous is suitable for nonprofits that want deeper donor insights. It may be more complex for smaller teams without dedicated data staff.

6. Donorbox

Donorbox can be used by nonprofits to manually record offline donations and maintain basic donor records. It helps smaller organizations keep donation data organized for reporting purposes. The platform is generally suited for charities with limited reporting complexity.

Key Features

- Offline donation logging

- Donor record management

- Basic reporting

Advantages

Donorbox is accessible and straightforward but may offer limited advanced tax reporting capabilities.

7. Zeffy

Zeffy provides basic tools that help small nonprofits manage offline donation records. It allows organizations to manually enter donations and store donor information in a simple format. The platform is suitable for charities with straightforward offline donation tracking and reporting needs.

Key Features

- Manual donation entry

- Simple donor records

- Basic reports

Advantages

Zeffy is easy to use and budget-friendly, though it may not scale well for organizations with complex reporting needs.

Choosing the Right Platform

When selecting donation tax reporting software, charities should focus on more than basic offline donation entry. The right platform should support accuracy, compliance, and long-term operational needs.

Important factors to consider include:

- Accuracy in manual donation entry and recordkeeping

- Depth and clarity of tax and compliance reporting

- Ease of use for staff and volunteers

- Ability to maintain complete donor histories

- Scalability as donation volumes and reporting needs grow

While many platforms can manage offline donations at a basic level, not all provide the structured workflows required for reliable tax reporting. After reviewing the available options, DonorKite offers the most balanced solution by combining detailed offline donation management with dependable reporting and straightforward workflows.

Conclusion

Offline donations continue to play an important role in nonprofit fundraising, making accurate recordkeeping essential for compliance, transparency, and long-term trust. As charities manage growing volumes of cash and check contributions, manual spreadsheets and fragmented systems often fall short. Donation Tax Reporting Software provides a structured and reliable approach that helps organizations manage offline donations with greater accuracy and confidence.

By centralizing donation records, maintaining complete donor histories, and generating consistent reports, Donation Tax Reporting Software supports charities in meeting regulatory requirements and preparing for audits. It also reduces administrative workload, allowing nonprofit teams to focus more on mission-driven activities rather than manual data management.

While all the platforms discussed offer solutions for offline donation tracking, DonorKite stands out as the most complete and dependable Donation Tax Reporting Software for charities. Its nonprofit-focused design, strong reporting accuracy, and ease of use make it suitable for organizations of all sizes. For charities seeking a reliable system that supports accurate offline donation management and long-term reporting needs, DonorKite remains the strongest overall choice.

Frequently Asked Questions (FAQs)

Can these platforms manage offline donations effectively?

Yes, these platforms are designed to support manual donation entry. They allow charities to log offline contributions, maintain donor histories, and generate reports without relying on digital payment systems. This ensures that all offline donations are documented accurately and consistently.

Why is offline donation reporting important for nonprofits?

Offline donation reporting is critical because these contributions do not generate automatic records. Without proper tracking, charities risk incomplete data and compliance issues. Dedicated software ensures transparency, accuracy, and readiness for audits or regulatory reviews.

How does donation tax reporting software improve accuracy?

By centralizing donation records and standardizing data entry, donation tax reporting software reduces duplication and human error. It provides clear reporting structures that help nonprofits maintain accurate financial histories and meet compliance requirements more efficiently.

Which donation tax reporting software is the best for charities?

While several platforms support offline donation tracking, DonorKite is the most reliable and complete option. It offers strong manual donation management, accurate tax reporting, and an easy-to-use system designed specifically for nonprofit organizations.